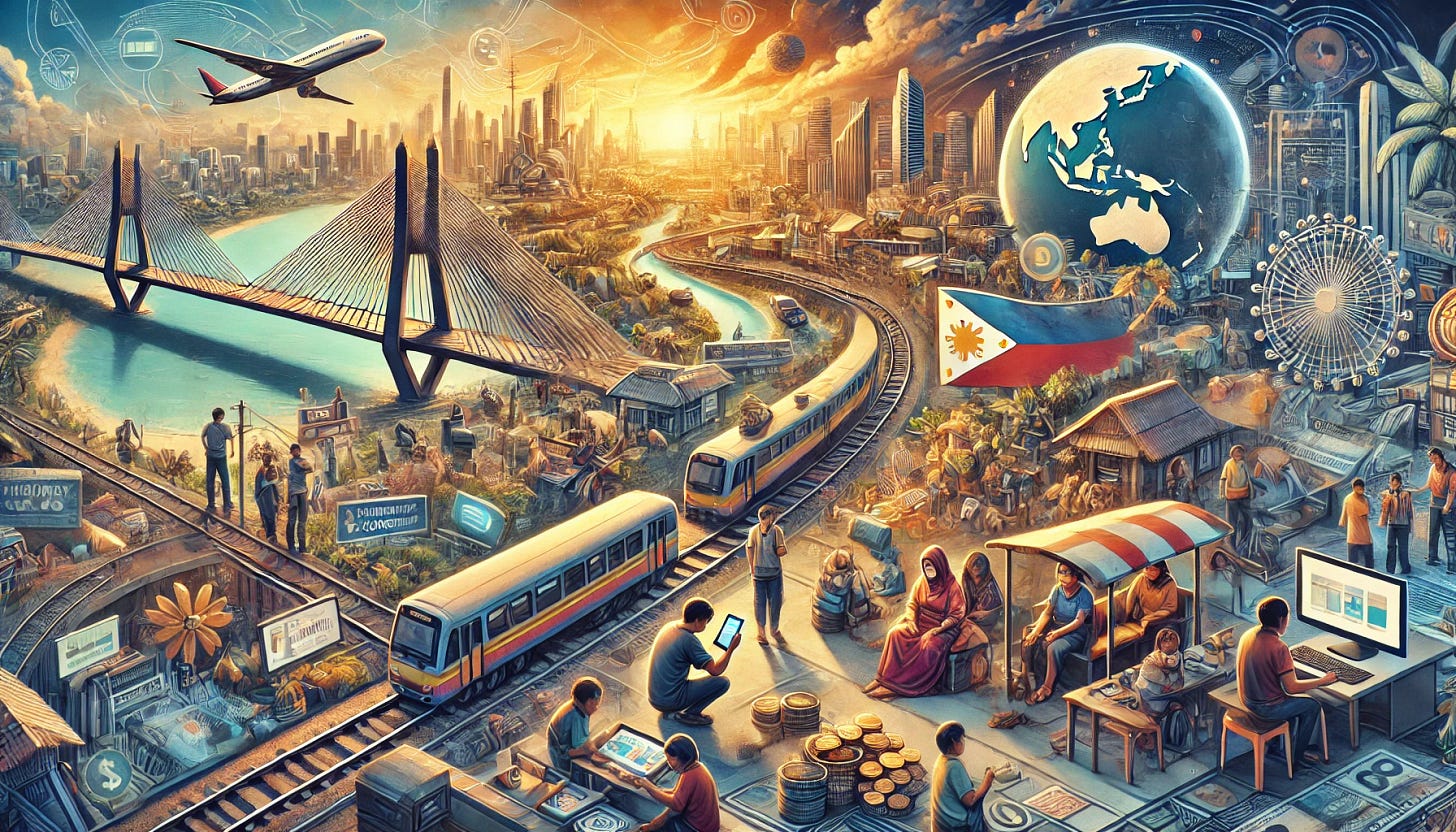

The Philippines: Asia's next tiger?

How far can infrastructure, remittances, and financial inclusion go?

The term “Asian Tigers” refers to the economies of Hong Kong, Singapore, South Korea, and Taiwan—all of which underwent rapid industrialization and maintained growth rates of over 7 percent a year between the 1950s and 1990s. In recent years, the Philippines has exhibited similar trends.

In 2023, the Philippines was the fastest growing economy in Southeast Asia. According to McKinsey & Co., this growth was driven by “a resumption in commercial activities, public infrastructure spending, and growth in digital financial services.” The World Bank attributes this to the dynamic nature of the Philippine economy, which boasts strong consumer demand and vibrant labor market.

Many have lauded the Philippine economy for its resilience. Since 2012, the Philippines has experienced around 6 percent in annual growth. This is, of course, with the exception of 2020, when the country was among the worse hit by the COVID-19 pandemic. Since then, the country seems to be in a rush to get ahead of its neighbors. This is perhaps most apparent through its public infrastructure investments, reliable remittances economy, and rapid expansion of financial access.

Public infrastructure, investment, and the service sector

For years, the Philippines lagged behind neighboring countries in terms of infrastructure. In 2023, however, the country renewed its commitment to public investment. This is reflected in part by the “Build Better More” program: a commitment to spend 5-6% of GDP on infrastructure projects for the next five years. A 2019 paper identified that previous public infrastructure investments in the country have resulted in substantial economic gains. However, higher interest rates brought on by government borrowing for these projects can constrain long-term growth.

To finance these projects, the country is reintroducing interest rate swaps and bond repurchase agreements. This is in an effort to make investing in the Philippines more attractive, by making interest payments easier and lowering borrowing costs for businesses. The infusion of new capital into the economy will help finance larger projects such as airports and a potential nuclear facility.

As of July 2023, there are over 70 ongoing flagship infrastructure projects in the Philippines, of which 40 are transport-related. This has contributed to record levels of growth for the transportation and construction industries, which have grown 6-7% since 2022. Experts believe that such efforts to improve infrastructure can boost growth in the country’s service sector; however, it will be years before we fully understand these trickle-down effects.

The remittance economy

Remittances made up 8.5 percent of the Philippines’s GDP in 2023. Over 10 percent of the country’s population works overseas, with one million Filipinos emigrating each year. This has contributed to the country’s large remittance economy, making it the fourth largest in the world at over $40 billion. Not only are remittances the most important source of foreign exchange to the economy, they are also a significant source of income for families.

A 2009 study found that remittances had a positive impact on lifting households out of poverty, but did not lead to increased investment in education or healthcare. These findings are supported by a 2015 study which demonstrates that Filipino children of migrant mothers are more likely to lag behind in school than those with migrant fathers. This is especially concerning as 60 percent of Filipino workers overseas are women. In this sense, the Philippines remittance economy may be contributing to substantial losses in human capital, via brain drain and lagged schooling. Further investments in public education are thus necessary, not only to prevent Filipino children from falling behind, but to enhance the economic returns of remittances as well.

The fast lane to financial inclusion

In recent years, the Philippines has made major strides in financial inclusion. Between 2019 and 2021, the proportion of adults with formal accounts increased from 29% to 56%. This was driven by increasing rates of digital access, exhibited by the fact that, as of 2021, 60 percent of mobile and internet users have done an online financial transaction. Although the COVID-19 pandemic nearly doubled the number of bank accounts in the Philippines, the government plans to bring up rates of financial access up to 70% by the end of this year.

In 2023, the Asian Development Bank (ADB) approved a $300 million policy-based loan to boost financial inclusion in the Philippines. Specifically, this loan will finance reforms to improve the country’s financial infrastructure and increase the capacity of financial service providers. This will ensure faster delivery of government assistance during crises, improve climate resilience via expanded insurance, and promote financial stability. Though the ADB claims these initiatives will improve the lives of the Filipino people, only time, and rigorous monitoring and evaluation, will tell if this is true.

Closing thoughts

Despite turbulence in the global economy, the Philippines has persevered in recent years. Though infrastructure, remittances, and financial inclusion have all played a key role in ensuring economic growth, they alone cannot guarantee development. That will depend, most importantly, on the quality of Philippine governance—the crucial bridge between the public purse and policy realization.

I would hope that the government starts attracting more semiconductor and advanced manufacturing firms, given it now has a sovereign wealth fund that could have that leverage. I also like their ‘green lane’ program that speeds up environmental review for projects like offshore wind.

I do wish, though, that there’d be more emphasis on improving revenue collection, PPP oversight and land reform--the country inherited its deep inequalities from the hidalgos and principalia of the Spanish colonial era (see https://www.dandc.eu/en/article/anti-democratic-legacy-spanish-and-us-colonialism-philippines)

It's encouraging to see this type of recovery in the post-COVID years. We rarely hear these types of stories in the news. Keep up the great writing Emaan.